Claiming What’s Yours: The IRS Statute of Limitations on Tax Refunds (RSED) – Federal & California

When it comes to tax timelines, most people worry about how long the IRS can collect—but few realize you have far less time to claim what’s rightfully yours. While tax debts can linger for 10 years under the Collection Statute Expiration Date (CSED), refunds typically expire in just three years—thanks to the lesser-known Refund Statute […]

When the Clock Stops: IRS Debt & the Collection Statute of Limitations Demystified

After ten years—or longer, if paused—the IRS legally loses the right to collect your assessed tax debt. That’s not just a rule buried in the tax code—it’s a strategic lifeline. Known as the Collection Statute Expiration Date (CSED), this deadline can be a game-changer for those facing long-term IRS pressure. For tax professionals and taxpayers […]

When the IRS Clock Runs Out: Navigating the 10‑Year Collection Statute of Limitations (CSED)

Here’s something the IRS won’t advertise — they don’t have forever to collect your tax debt. In fact, the law gives them just 10 years from the date of assessment. After that, the debt expires. No more calls. No more collection notices. It’s over. This deadline, called the Collection Statute Expiration Date (CSED), is one […]

Business or Hobby? What the IRS Cares About

Is your side hustle a business or just a hobby? It’s more than just a label—it can make or break your tax strategy. The IRS, under IRC §183 (the “hobby loss rule”), determines this based on factors like your profit motive, expertise, and how much time you put in. Businesses can deduct ordinary and necessary […]

How to Choose the Right Tax Advisor in Burbank

Nearly 60% of Americans hire a tax professional—and for good reason. With the ever-changing tax code and rising IRS scrutiny, even a small filing mistake can cost you time, money, or trigger an audit. In Burbank, where freelancers, business owners, and investors are common, working with a skilled CPA, Enrolled Agent (EA), or tax attorney […]

Tax Planning for Small Businesses in Burbank: A Local Guide

Small businesses in Burbank benefit from proactive tax planning that accounts for federal, California, and local rules. Unlike many cities, Burbank does not use a gross receipts tax; instead it charges a flat base fee plus an annual per-employee. (1) In fact, the City requires “all businesses located in Burbank, as well as businesses that […]

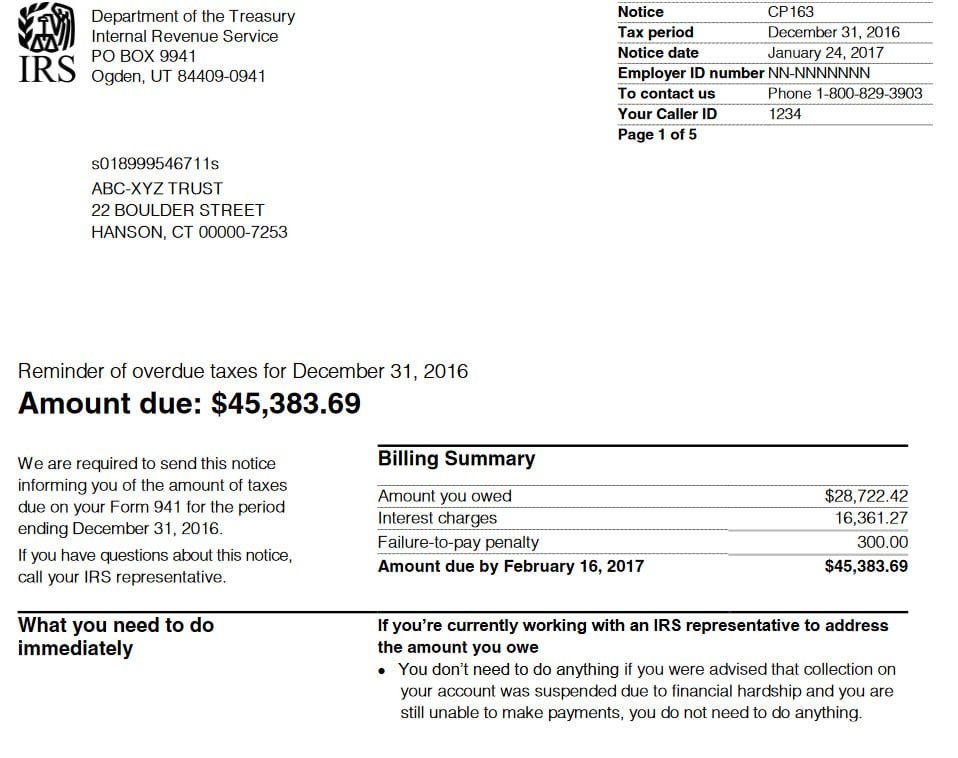

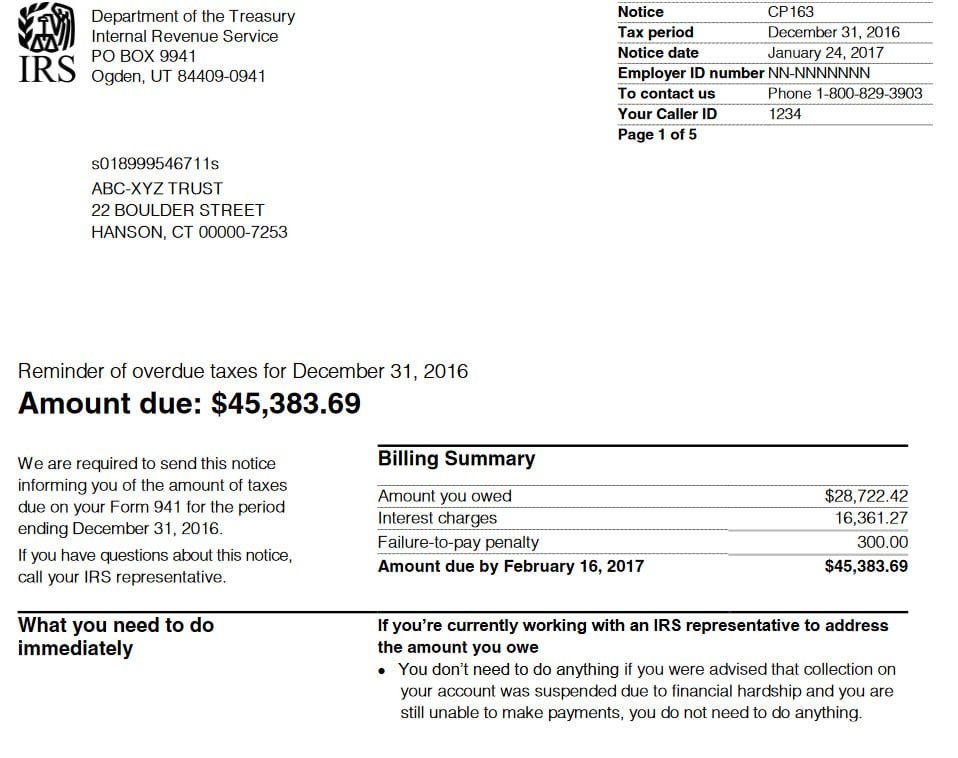

CP163 – Reminder Notice of Past Due Taxes

Reason: You still have an unpaid tax balance from a previous year, and the IRS is reminding you to resolve it. Impact: Penalties and interest continue to accrue. Ignoring this notice can lead to more serious collection actions, including liens or levies.

CP504 – Final Notice Before Levy

Reason: IRS has not received payment after earlier notices. Impact: IRS intends to seize property or garnish wages if you do not respond.

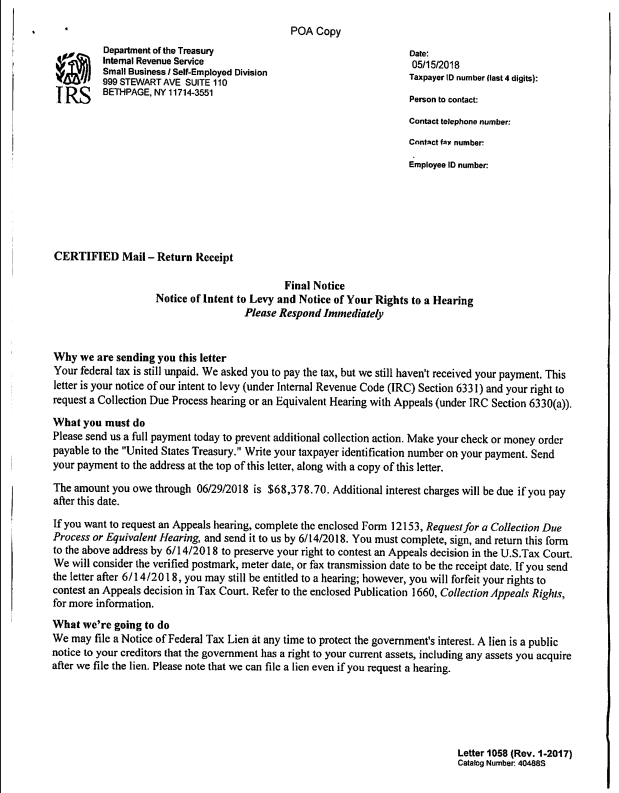

LT11 / Letter 1058 – Final Notice of Intent to Levy and Right to a Hearing

Reason: The IRS is about to take aggressive collection action, including wagegarnishment or bank levy. Impact: This is a last warning before the IRS seizes assets.

CP90 / CP297 – Notice of Intent to Levy on Social Security or Other Assets

Reason: IRS plans to levy specific federal payments or assets. Impact: Social Security payments or other federal income streams can be seized.