Business or Hobby? What the IRS Cares About

Is your side hustle a business or just a hobby? It’s more than just a label—it can make or break your tax strategy. The IRS, under IRC §183 (the “hobby loss rule”), determines this based on factors like your profit motive, expertise, and how much time you put in. Businesses can deduct ordinary and necessary […]

How to Choose the Right Tax Advisor in Burbank

Nearly 60% of Americans hire a tax professional—and for good reason. With the ever-changing tax code and rising IRS scrutiny, even a small filing mistake can cost you time, money, or trigger an audit. In Burbank, where freelancers, business owners, and investors are common, working with a skilled CPA, Enrolled Agent (EA), or tax attorney […]

Tax Planning for Small Businesses in Burbank: A Local Guide

Small businesses in Burbank benefit from proactive tax planning that accounts for federal, California, and local rules. Unlike many cities, Burbank does not use a gross receipts tax; instead it charges a flat base fee plus an annual per-employee. (1) In fact, the City requires “all businesses located in Burbank, as well as businesses that […]

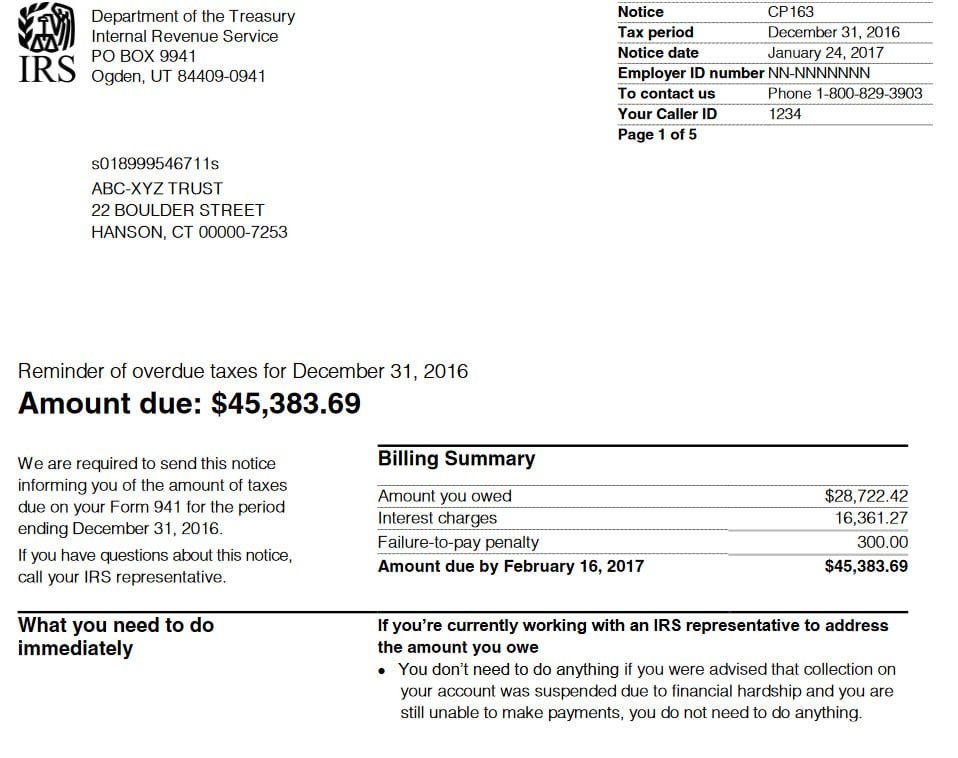

CP163 – Reminder Notice of Past Due Taxes

Reason: You still have an unpaid tax balance from a previous year, and the IRS is reminding you to resolve it. Impact: Penalties and interest continue to accrue. Ignoring this notice can lead to more serious collection actions, including liens or levies.

CP504 – Final Notice Before Levy

Reason: IRS has not received payment after earlier notices. Impact: IRS intends to seize property or garnish wages if you do not respond.

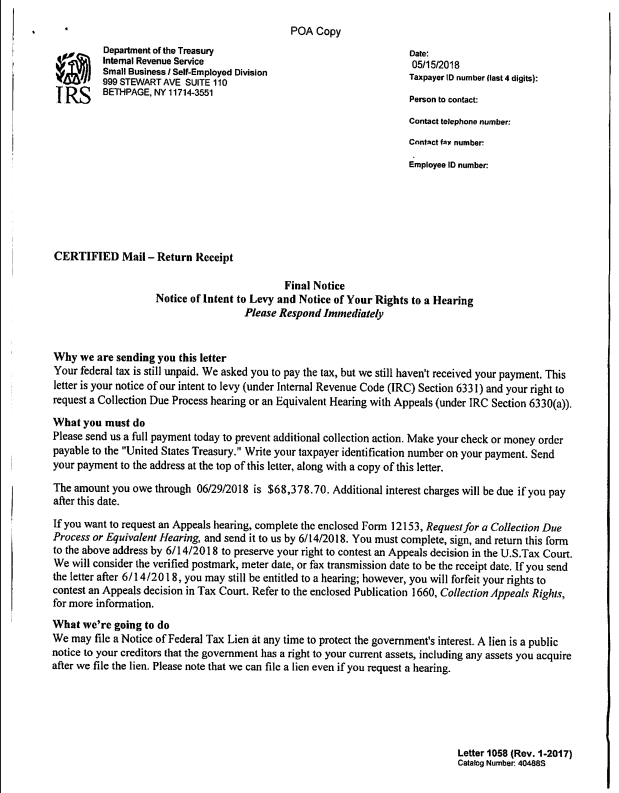

LT11 / Letter 1058 – Final Notice of Intent to Levy and Right to a Hearing

Reason: The IRS is about to take aggressive collection action, including wagegarnishment or bank levy. Impact: This is a last warning before the IRS seizes assets.